Service hotline

+86 0755-83044319

release time:2022-03-28Author source:Dr. Feng JinfengBrowse:1039

Dad. Before 1987, most of the integrated circuit industries in the world were in IDM mode, that is, the three processes of chip design, production and testing and packaging were completed within the enterprise. Intel, Samsung, Hynix and Micron are the representative enterprises of IDM. In addition to meeting their own needs, the chip production capacity of Intel IDM giants occasionally provided a small amount of chip processing and manufacturing services to the outside as a sideline. At that time, there was no professional OEM service in the market.Son. In 1987, with the deepening of industrialization of products and the increasing specialization of social division of labor, Foundry-Fabless model was derived from IDM model. TSMC in Taiwan Province founded the world's first pure OEM chip manufacturing enterprise, freeing chip design enterprises from capital-intensive and asset-intensive manufacturing business. Foundry's representative enterprises include TSMC, Grofeld, UTC, SMIC, Hua Hong Group, etc. Fabless is full of stars, such as Qualcomm, Broadcom, Nvidia, MediaTek, HiSilicon and so on.

二、Grandpa is still alive.

There is an old model, which was adopted by the early American IBM, the middle European powers and the recent Japanese giants. IDM only integrates design, manufacturing, packaging and testing. Compared with integrated circuit IDM companies like Intel in the United States, Japanese companies are not IDM companies in the strict sense. They go further than IDM, and the upstream and downstream are more closely tied. We might as well put Japanese semiconductor companiesThis model is calledIDMP,Here, P refers to Product, which is the model of grandfathers.。Until 1990' s, Japan's semiconductor business was almost all sub-departments under large groups, and its demand for semiconductor technology and chip products came from the group's own terminal products. This is completely different from the IDM enterprises like Intel in the United States, which are fully committed to meeting the most extensive technical and product requirements in the market. The former customer is its own parent company group, and its demand is stable, but it is easy to have irresistible fluctuations due to the fluctuations of the parent company group; The latter is the whole market, with huge space and a wide range of technical challenges, which is conducive to the improvement of the comprehensive performance of products. Japan's IDMP, in the early stage of semiconductor development, Japan gained a certain leading edge by virtue of its IDMP mode, especially the brilliant achievements of Japanese enterprises in the terminal markets such as small household appliances, which indirectly led to the rapid development of Japan's semiconductor industry, and once cultivated world-class electronic integrated groups such as Sony, NEC, Toshiba, Hitachi and Fujitsu.The disadvantages of IDMP are also obvious. First of all, the semiconductor departments of large groups have fixed sales direction and R&D direction, lack of competitive environment and weak motivation for technological innovation. Secondly, the semiconductor department is easily influenced by the terminal department of the group. If the terminal sales are good, the performance of the semiconductor department will be good, and vice versa. Japan once occupied most of the downstream applications of semiconductor industry, including TV, PC, radio, home appliances, etc. When the outlet is transferred to mobile intelligent terminals such as mobile phones and tablets, the terminal manufacturing in Japan is shrinking rapidly, resulting in the lack of Japanese companies among the top six mobile phone manufacturers in the world, which indirectly leads to the shrinking of Japanese semiconductor industry. The semiconductor sector, which is pampered in large groups, also lacks the motivation to innovate, and the benefits of the group are not good, so the R&D support for the semiconductor sector is correspondingly reduced. Coupled with the traditional lifelong employment system in Japan, young people aim to work in big factories for a lifetime. It's hard to see the spark of Silicon Valley-style semiconductor entrepreneurship in the United States outside big Japanese groups."IDMP mode" is not a national characteristic of Japan, and the semiconductor industry in Europe has a similar experience. Siemens in Germany and Philips in the Netherlands are both integrated electronic information groups, and their semiconductor divisions are very strong. In 1999, Siemens Group of Germany separated its semiconductor business and set up a new company, which is INFINEON of Germany, an IDM enterprise, which ranks second in the world of automotive electronic chips today. Philips Group of the Netherlands separated its semiconductor business in 2006 and set up a new company, which is NXP Company of the Netherlands, which ranks first in the world of automotive electronic chips today.

三、A domineering father.

There is a common view that design companies can do IDM on the production line when they have the conditions. The cost of opening a chip factory at the low end is USD 1 billion, and if you want to operate at the operation level of UTC or Grofond, the cost is USD 50 billion. The head of MediaTek in Taiwan Province once commented: "If an IDM company's turnover exceeds USD 5 billion, I believe they can still maintain their own fabs, but if it is a medium-sized factory under USD 2 billion or USD 3 billion, I'm afraid it must develop into a Fabless design company." This sentence can also be understood as, if the annual income of a pure chip design company reaches the level of $5 billion, then IDM mode can be considered in terms of economic strength.MediaTek's revenue in 2021 was as high as $17.4 billion, far exceeding its declared economic threshold of being able to build its own factory for IDM, and then did not make such a choice.今天Almost all IDMs were established before 1990.。30Over the years, since then, no large design company has transformed IDM.,Including Qualcomm (revenue 26.8 billion USD in 2021), Broadcom (revenue 18.7 billion USD in 2021), Nvidia (revenue 16.2 billion USD in 2021) and so on. As an established IDM company, AMD stripped off all its chip manufacturing sectors in 2015, that is, today's Grofeld Company of the United States, and withdrew from the IDM mode.Why do you say dad is domineering? Two reasons:First, being an IDM requires deep pockets. Its factory equipment not only has a high one-time investment, but also needs tens of billions of investment every 2-3 years, which is an extremely heavy capital expenditure burden. Even in the capital-rich United States, only Intel is lucky enough to lead the personal computer industry, which enables it to invest heavily in the development of logic technology, making it an unparalleled leader in this field, and relying on monopoly profits to continuously invest in factories. As for Micron, another IDM company in the United States, it is also because it is located in a relatively low-cost area in the United States (Idaho), which enables it to survive the low tide of semiconductors in the 1990s and early 2000s.Second, IDM enterprises have built extremely high wall barriers, and most of them are in a dominant position in the industry, whether it is Intel for CPU, Texas Instruments for analog chips, Samsung, Hynix and Micron for memory chips.

四、Vibrant son

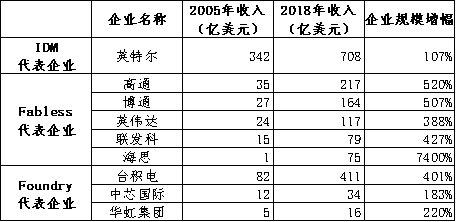

The birth of Foundry-Fabless mode has greatly lowered the threshold of chip design. A few experienced chip engineers can set up a team to carry out chip design business, and then pay for chip foundry enterprises to process and produce, forming independent brand products. The income scale of Fabless enterprises is also rising, and they are competing with the traditional IDM giants. The professional people of Foundry manufacturers do professional things, concentrate on increasing R&D investment, improving capacity utilization, reducing costs, and making a lot of money. According to the statistical data from 2005 to 2018, the growth rate of Foundry and Fabless enterprises far exceeds that of Intel, the leading IDM enterprise in the same period.

An interesting phenomenon is that Grofangde, spun off by AMD, has become the second largest Foundry in the world, and its operation performance has been unsatisfactory. It has suffered a net loss for many years, which is completely incomparable with the annual net profit rate of the largest TSMC, which exceeds 30%, and its benefits are even far worse than those of SMIC and Hua Hong Group, which are the fifth and sixth largest companies. This, in turn, shows that the chip manufacturing business under the original AMD IDM mode really has no professionalism and cost performance, and has no market competitiveness. Is it eroding the old capital of the design business?

Dads are all moving towards the son mode.。

Although my father is domineering, he sometimes feels guilty. Because dad needs to cover all aspects and take charge of all aspects of affairs, when competing with young people, he is often unable to do so in some aspects. In the practice of semiconductor industry, prominent dads are moving closer to the son mode.1. For example, AMD in the United States thinks about everything from side to side, and finds that the huge factory has affected its focused investment in design. It has split the factory, and the strong man's broken wrist can be brilliant again.2. For example, yesterday's Samsung Electronics has successfully cultivated the Foundry board from 100%IDM, and has become the second largest chip foundry company in the world after TSMC, and has set the goal of "making chip foundry the number one in the world by 2030".3. For example, yesterday's Texas Instruments, Infineon and NXP Renesas no longer insisted on 100%IDM, but threw the incremental demand of chip manufacturing to TSMC and other foundry companies.4. Today's Intel, for example, found that the upgrading of chip manufacturing technology has been lost to young TSMC, and is hesitating to learn AMD.

五、Chinese people all want to be fathers, but sons are the future.

Now we can see that TSMC, Qualcomm, Nvidia, Broadcom, etc. have chosen the youngest "Foundry/Fabless" model, which is full of vigor and vitality! Intel, Texas Instruments, NXP, Infineon, etc. have chosen to adhere to IDM mode, which is mature and steady! Only Japanese semiconductor companies all over the world have always adhered to the grandpa mode, and they are old and senile! It was not until mitsubishi electric Semiconductor Division, Hitachi Semiconductor Division and NEC Electronics had a difficult operation that they separated from their respective headquarters and reorganized into Renesas Electronics that Japanese semiconductors partially entered IDM mode from IDMP mode.China's practice is different.The common view is that China is facing the high-tech blockade of the United States and even the whole western world, and it will face the huge risk of overseas chip foundry companies refusing to contract for them. Therefore, it is necessary for design companies to transform IDM. Therefore, in recent years, Hangzhou Shilanwei, Wuxi Huarunwei, BYD Semiconductor, Gekewei, Wentai and Zhuoshengwei are all changing to IDM mode.The author believes that it is necessary for some pure chip design enterprises with economic strength to build factories to solve the capacity supply in the short term. From the actual situation, related enterprises focus more on non-advanced technologies such as simulation and power, which are really far from quenching thirst, and cannot be satisfied from professional foundries in a short time for two reasons. First, the OEM enterprises at the head are busy with the expansion of 12-inch advanced production capacity, and they don't have much energy on these non-advanced processes. Second, China's national conditions, local head OEM enterprises are far from the stage where TSMC has huge profits and can make self-recycling investment, so they are highly dependent on funds from national and local government industrial investment platforms. As we all know,No matter the state ministries or local governments, they are more inclined to make high, large and high-quality production lines and products, expecting breakthroughs rather than "low-level redundant construction". Therefore, although the head foundry enterprises recognize the profitability of non-advanced processes, it is difficult to get sufficient funds to complete 8 inches or even124 inches5Investment in the following nanometer production lines。

However, in the long run, it depends on the cost performance and the market competitiveness of products. Will there be dozens or hundreds of semiconductor enterprises in China who are good at chip design, chip manufacturing and factory management? Obviously, no, after all, there is specialization in the industry, and it is not certain that you can achieve a beautiful goal with strong will. in additionSome domestic consumer electronics giants, automobile giants, communication giants, and power grid giants have gone out to do chip design in person. Although the integration of chip design, manufacturing, and end-user has not been formed yet, the chip design+end-customer model is taking the old way of Japanese IDMP's grandfather model after all. I don't think this is a long-term solution.。

I think that in the next few years, IDM enterprises in China will be divided into three destinations:First, it's still an IDM enterprise, mostly in simulation and storage.Second, the manufacturing is stripped off and returned to pure chip design enterprises.Third, the transfer of control rights to the head foundry enterprises not only ensures the supply of the original production capacity, but also avoids distracting excessive energy on the manufacturing business that is not good at.The third mode is actually the direction that Sony Group of Japan is taking. Sony is the leader in the global CMOS image sensor industry and has always been an IDM enterprise; Considering that Sony CMOS image sensors were mainly sold to cameras, mobile phones, video cameras and other business divisions within the group, Sony was an IDMP enterprise at that time. Today, Sony chose to cooperate with TSMC to build a 12-inch advanced production line in Japan, which is specially used to meet Sony's production capacity demand, and the Japanese government has given huge subsidies accordingly.

Disclaimer: This article is reproduced from the "Internet". This article only represents the author's personal views, not the views of Sacco Micro and the industry. It is only for reprinting and sharing to support the protection of intellectual property rights. Please indicate the original source and author when reprinting. If there is any infringement, please contact us to delete it.

links exchange: SiteMap

Copyright ©2015-2022 Shenzhen SlkorMicro Semicon Co.,Ltd. All rights reserved